Governor Larry Hogan today introduced the RELIEF Act of 2021, an emergency legislative package that will provide more than $1 billion in direct stimulus and tax relief for Maryland working families, small businesses, and those who have lost their jobs as a result of the COVID-19 pandemic. This legislation builds on the more than $700 million in emergency economic relief that the governor has already announced.

Governor Larry Hogan today introduced the RELIEF Act of 2021, an emergency legislative package that will provide more than $1 billion in direct stimulus and tax relief for Maryland working families, small businesses, and those who have lost their jobs as a result of the COVID-19 pandemic. This legislation builds on the more than $700 million in emergency economic relief that the governor has already announced.

“With the start of a new 2021 legislative session on Wednesday, we are now asking the legislative branch to assist by immediately passing this stimulus and tax relief package to help even more struggling families and small businesses across our state,” said Governor Hogan. “We will be introducing the RELIEF Act of 2021 as emergency legislation on day one. We will ask both houses of the legislature to act on it immediately, so that I can immediately sign it into law, and these relief measures can take effect—all so that we can immediately get these much-needed dollars out the door and into the pockets of those who desperately need it.”

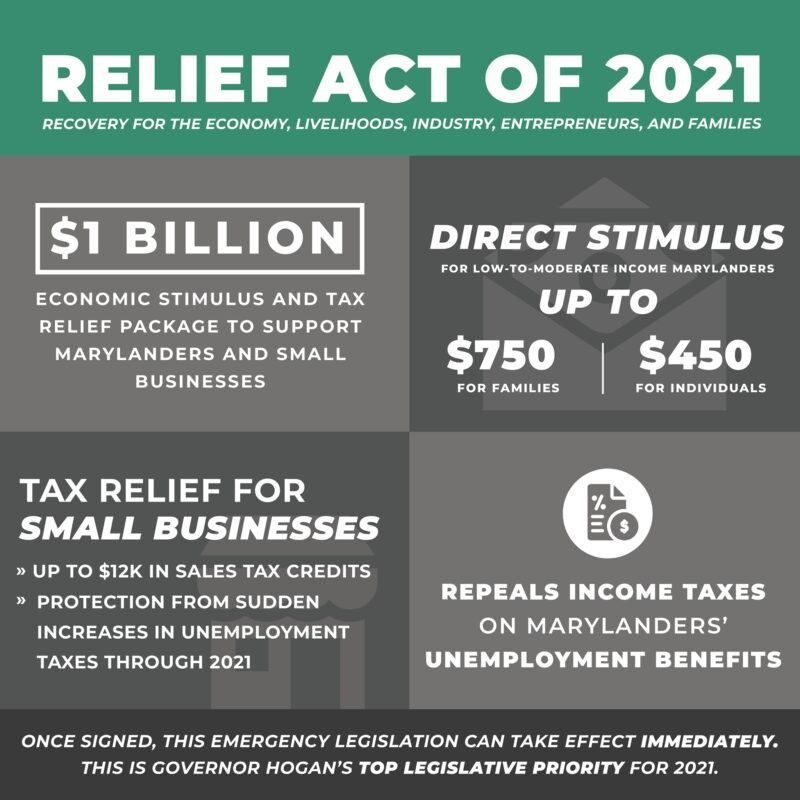

The $1 Billion RELIEF Act. The Recovery for the Economy, Livelihoods, Industries, Entrepreneurs, and Families Act includes the following economic stimulus and tax relief:

- Provides direct stimulus payments for low-to-moderate income Marylanders, with benefits of up to $750 for families and $450 for individuals. This relief begins with immediate payments of $500 for families and $300 for individuals who filed for the Earned Income Tax Credit, followed by a second-round stimulus for EITC filers that would provide an additional $250 for eligible families and $150 for individuals. This relief will directly help more than 400,000 Marylanders. Similar to federal stimulus payments, no application for relief is necessary. ($270 million)

- Repeals all state and local income taxes on unemployment benefits, providing further support and assistance for Marylanders who have lost their jobs. ($180 million)

- Supports small businesses with sales tax credits of up to $3,000 per month for four months— for a total of up to $12,000—freeing-up much needed resources to protect payrolls and sustain operations. This relief will directly help more than 55,000 Maryland small businesses. ($300 million)

- Extends unemployment tax relief for small businesses, staving off sudden and substantial tax hikes in 2021. This provision codifies an emergency order the governor issued last month. ($218 million)

- Safeguards Maryland businesses against any tax increase triggered by the use of state loan or grant funds. ($40 million)

The RELIEF Act will be introduced as emergency legislation so that it can take immediate effect upon enactment. A summary of the bill is available here. The legislation is funded through the remaining surplus at the end of Fiscal Year 2020, difficult budget reductions, and a small portion of the state’s Rainy Day Fund.

During today’s press conference, the governor also provided an update on the new federal COVID-19 relief bill, which will provide Marylanders with an additional nearly $15 billion, including:

- $7.14 billion in business assistance funding, including an additional $5.5 billion through the Paycheck Protection Program;

- $4.18 billion in individual assistance funding, including an additional $2.59 billion for direct stimulus payments, $1.38 billion for extended unemployment insurance, and $211 million for enhanced SNAP benefits;

- $925 million for K-12 school, and $130 million for child care;

- $400 million for rental assistance, which can be used to help pay for rent and utility bills;

- $336 million for COVID-19 testing and contact tracing, and $75 million for vaccination programs;

- $257 million for the transportation sector; and

- $58 million to expand broadband access.